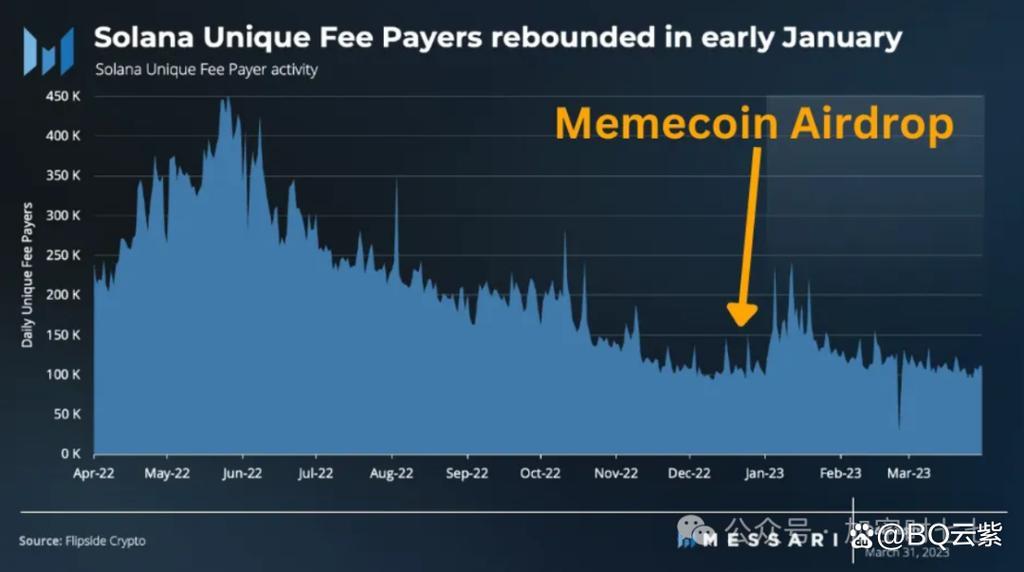

The value of Solana’s cryptocurrency is influenced by a myriad of factors, leading to its notorious price fluctuations. Among these,market sentiment plays a pivotal role. When positive developments occur,such as upgrades to the network or collaborations wiht important projects,enthusiasm can drive prices higher. Conversely, negative news—like security breaches or widespread criticism—can lead to sharp declines. Additionally, the overall trends in the broader cryptocurrency market, including movements in Bitcoin and ethereum prices, can have a cascading effect on solana, as traders often react similarly across digital assets.

another key aspect influencing Solana’s price dynamics is supply and demand. The balance between the number of coins being bought and sold creates natural volatility. As more developers tap into Solana’s high-speed, low-cost network for decentralized applications, demand surges, pushing prices upwards. Moreover,the expansion of decentralized finance (DeFi) projects built on Solana further enhances its utility,attracting more investors. To visualize these dynamics, consider the following table summarizing recent trends:

| Factor | Impact on Price |

|---|---|

| Market Sentiment | High impact: Positive news boosts price, while negative news can cause drops. |

| Supply and Demand | Direct correlation: Increased demand leads to price surges; oversupply can lower prices. |

| Broader Crypto Trends | Indirect influence: Movements in major currencies affect Solana’s market dynamics. |

| Network Developments | Significant impact: Upgrades and partnerships often lead to price thankfulness. |