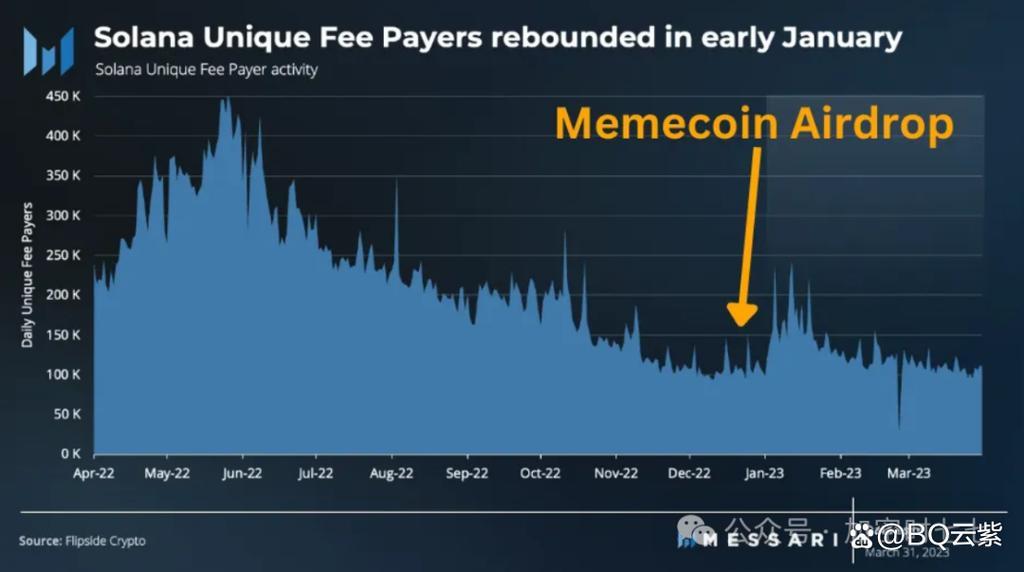

Over the past few months, Solana has seen critically important price fluctuations that have left many investors and enthusiasts puzzled. This volatility can be attributed to several factors, including the broader market sentiment, technological developments, and macroeconomic conditions. The cryptocurrency landscape is often influenced by the news cycle, with major announcements from regulatory bodies or technological upgrades contributing to rapid shifts in investor confidence. For Solana, it’s unique position as a high-performance blockchain means that perceptions of its scalability and transaction speed can sway market sentiment dramatically.

in addition to external forces, the internal ecosystem of Solana also plays a crucial role in its price dynamics. Key elements include:

- Network Upgrades: Regular improvements to the protocol can boost investor confidence,while delays can lead to skepticism.

- Partnerships: Collaborations with other platforms and projects frequently enough influence perceived value and usability within the crypto space.

- Market Speculation: The crypto market is notorious for speculative trading, which frequently enough magnifies price movements.

To put this into perspective, here’s a brief summary of Solana’s recent price behavior compared to other leading cryptocurrencies:

| Cryptocurrency | Price Change (Last 30 Days) |

|---|---|

| Solana (SOL) | +15% |

| Ethereum (ETH) | +5% |

| Bitcoin (BTC) | -2% |